12-27-2024 Continued Update

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports. More info here.

12-4-2024 Important Update

BREAKING UPDATE: The U.S. District Court for the Eastern District of Texas has issued a preliminary injunction blocking the U.S. Department of Treasury from enforcing the reporting requirements of the beneficial ownership information (BOI) of the Corporate Transparency Act (CTA).

What does this mean for business?

The court’s preliminary injunction essentially removes the obligation for business owners to comply with the CTA reporting mandates.

What should I do if I have already filed a BOI report?

Legal experts recommend that businesses and organizations contact their legal advisors with any detailed questions about the CTA and/or BOI’s previous requirements.

Beneficial Ownership Information (BOI) refers to identifying information about the individuals who directly or indirectly own or control a company.

Why Do Companies Have to Report BOI?

In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law created a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

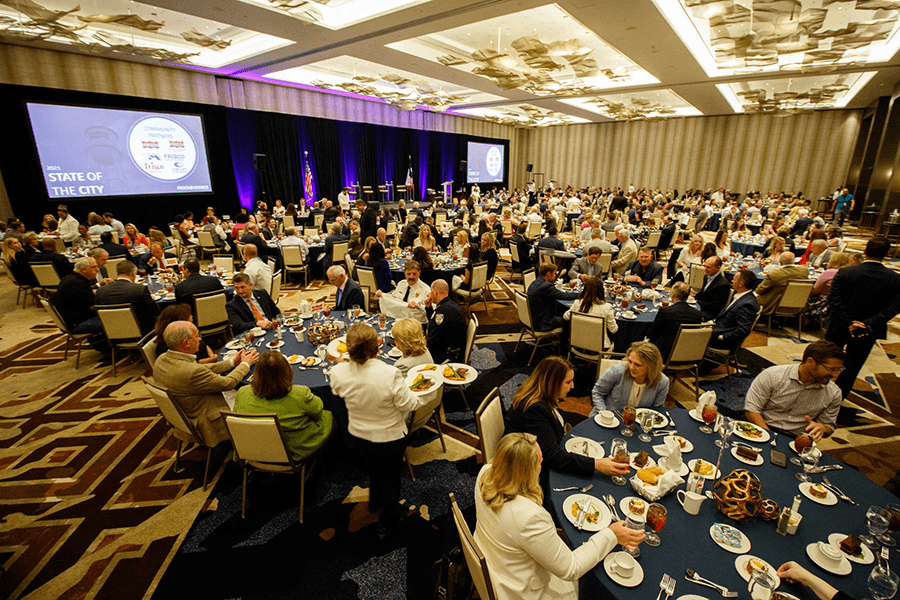

BOI Webinar

In this informative webinar, we hear from Channing Mavrellis, a Guidance and Outreach Advisor with the Financial Crime Enforcement Network. In this webinar, Channing provides resources and answers to numerous questions and walks you through the process of registering. You’ll also learn important dates and timelines.