Prioritizing Financial Literacy in Texas High Schools

Why would a chamber of commerce be passionate about requiring financial literacy in Texas public high schools as a requirement for graduation? The mission of the Frisco Chamber of Commerce is to protect and promote commerce through advocacy, resources, and connections. Strong commerce requires a financially literate workforce at every level, from hourly employees to the C-Suite.

The Costs of NOT Requiring Financial Literacy

The cost of not requiring financial literacy education in our Texas public schools is burdensome on business:

- 49% of employees who are distracted by their finances at work say they spend three or more working hours each week thinking about or dealing with issues related to their personal finances.

- 156 hours – time an employee spends in a year distracted from work by personal money matters.

- $3,922 average per employee – the business pays financially stressed employees to NOT work, but fret over money on the job.(Morgan Stanley – Graystone Consulting)

A Few More Reasons to Worry

Employee financial worries are real. Let’s take a look at some numbers that cause stress and negatively impact Texans’ quality of life.

- $8,681 – Texans have 9th highest credit card debt average in the nation, according to WalletHub.

- Texas ranks #2 in the U.S. with the biggest debt increase in the country in Q2 of 2022.

- Generation Z saw the largest increase of 11.6% of their credit card balance, according to com, with an average balance of $2,282.

- 32% of Americans have paid a bill late in the past six months and 61% say it’s because they didn’t have enough money.

- 46% of those who’ve missed a payment in the past six months say it was a utility bill, followed by credit cards at 39%. (com)

- Texas is #4 of the Top 10 States with the LOWEST CREDIT SCORE at 688.

- In Texas – there are 3,645,200 student borrowers who owe $120,000,000 on student loans.

- 3% of those borrowers are under the age of 35, with 20.3% owing $20,000 – $40,000.

- Texans owe (on average) $32,920 in student loan debt

Introducing HB 4342

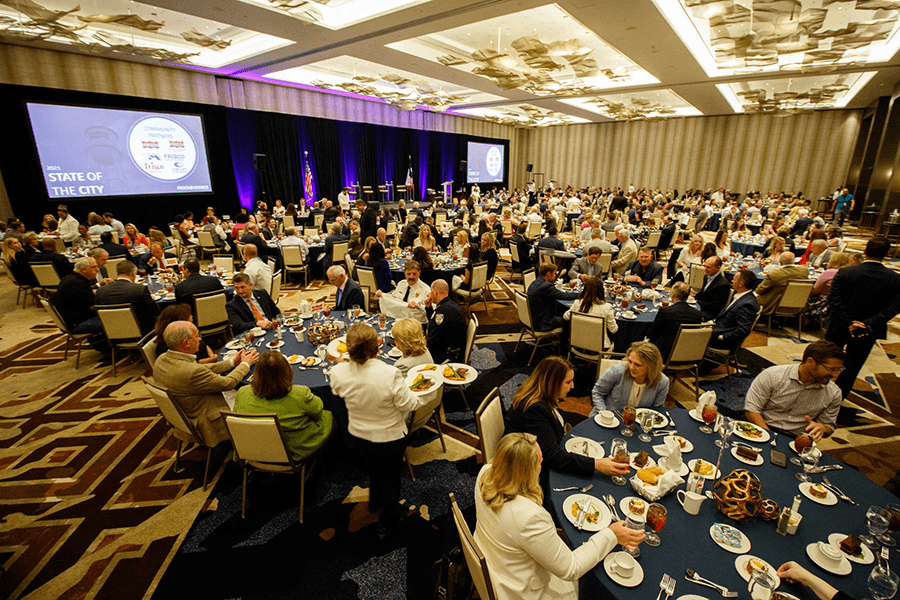

The Frisco Chamber of Commerce is proud to have worked with legislators to present House Bill 4342, designed to make financial literacy a requirement of graduation from Texas public schools.

“A message we hear over-and-over from the business community, is that employees lack the fundamental understanding of finance, not only in their job requirements, but on a personal level, as well. Building upon the strong foundation of Senate Bill 1063, our goal is to work alongside key stakeholders in public education, to equip our high school students for excellence in the workforce. By filing HB 4342, working with Rep. Plesa and other delegates, we’re having the conversation of what financial literacy excellence can look like if it becomes a graduation requirement in Texas public high schools,” shares Tony Felker, President and CEO of the Frisco Chamber of Commerce.

You can follow the process of HB 4342 online and we will send updates throughout the 88th Legislative Session, on this and other filings that affect the businesses of Frisco. If you’re interested in joining us as a champion for financial literacy, email Maureen and we will get you connected in an area you’d like to serve.

Frisco Chamber's Strategic Plan

In late 2021, the Frisco Chamber adopted a new strategic plan, titled “Transformation.” The overarching goal for the future is to remain relevant and essential to the businesses and be a more purposeful and productive resource to the community. The new strategic plan connects this vision to strategic initiatives, priorities, and goals, and focuses on three key initiatives – workforce issues/advocacy, small business ecosystem, and community nonprofit assistance, with a fourth initiative, financial literacy, woven into all three initiatives.

Stay tuned on this initiative and other work we are doing in the community, thanks to the support of our members!