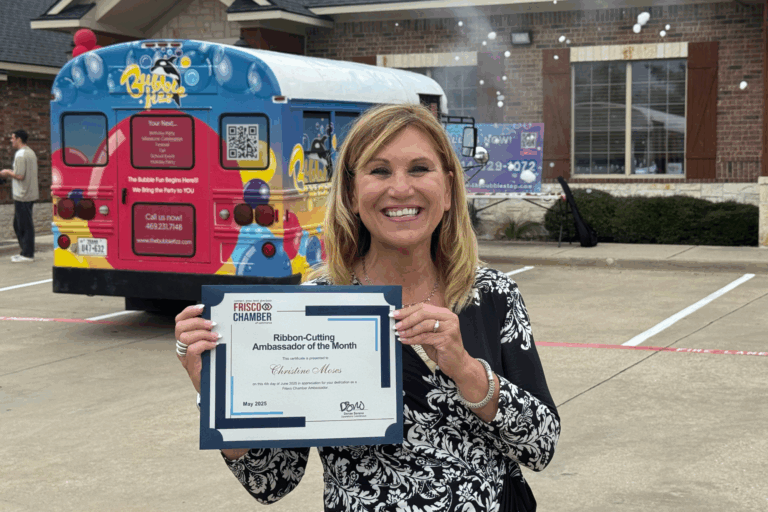

On June 12, 2019, Governor Abbott signed Senate Bill 2 into law. The legislation in part aims to provide property taxpayers with more transparency. The appraisal process will no longer be at the same time as the rate setting by the taxing entities. This way, property taxpayers would receive a notice that looks similar to the proposed one below. Prior to approval of the rates, that notice will show taxpayers the proposed rate by each of their taxing entities, the exact difference in amount of money that they would have to pay in the upcoming year, and information on when and where the meeting of the board for the taxing entity was to approve that change.

Sample Notice for Taxpayers Credit: Office of the Speaker of the House

While Senate Bill 2 will not lower your tax bill, the legislation in part will change when voters are given the ability to vote on a taxing entity's plan to increase revenue from the previous year, from the current 8% growth on a year-to-year basis, which is in current state law. Cities and counties will be required to hold an automatic election when the revenue from property taxes increases by more than 3.5%.