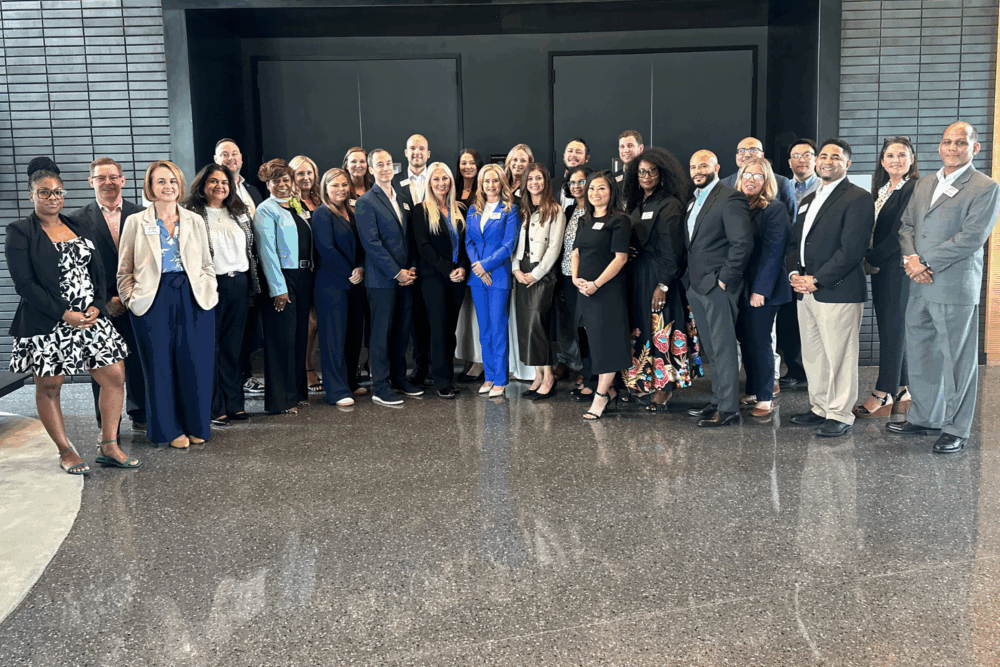

U.S. Chamber of Commerce and Frisco Chamber of Commerce Host Roundtable with Congressman Pat Fallon on Pro-Growth Tax Policy

Frisco, Texas — The U.S. Chamber of Commerce and the Frisco Chamber of Commerce recently hosted U.S. Representative Pat Fallon (R-TX-4) for a roundtable discussion at HALL Park in Frisco, Texas, on Friday, October 24, 2025, bringing together local business leaders and Frisco Chamber Board members to discuss the importance of extending pro-growth business tax provisions before portions of President Trump’s 2017 Tax Cuts and Jobs Act (TCJA) expire at the end of the year.

The conversation focused on how maintaining these key provisions will help strengthen the North Texas economy, support small businesses, and sustain economic growth across the region. Without Congressional action, the nation will face the largest automatic tax increase in American history.

Dynamic and Diverse Business Community

“The Frisco Chamber of Commerce was honored to host the U.S. Chamber’s Roundtable with Congressman Pat Fallon,” said Christal Howard, President/CEO of the Frisco Chamber of Commerce. “Frisco’s business community is one of the most dynamic and diverse in the nation, spanning startups, entrepreneurs, and companies of all sizes. Our members appreciated the opportunity to share how pro-growth tax policies impact their ability to innovate, create jobs, and strengthen our economy. Congressman Fallon’s openness and engagement reflect his strong commitment to the businesses that drive Frisco’s continued success.”

Frisco is Leading the Way

“I very much appreciate the Frisco Chamber of Commerce inviting me to participate in their round table discussion today,” commented Rep. Pat Fallon. “It’s always amazing to hear how local business leaders are driving tremendous economic growth for Collin and Denton Counties. As one of the fastest growing cities not only in Texas, but in the entire country, Frisco is leading the way by attracting significant private investment from a diverse array of industries. Low taxes and reasonable regulations have made Frisco one of the friendliest business environments in America, and I am proud to see how the Frisco Chamber is charting the way forward for prosperity.”

“We appreciate Congressman Fallon for joining the U.S. Chamber and Frisco Chamber diverse business leaders for a substantive conversation on the new tax law and other crucial issues for Collin County workers and businesses,” said Monique Thierry, Vice President of the Southwest/South Central region at the U.S. Chamber of Commerce. “It was clear from the conversation that the tax cuts are positively impacting businesses in Texas.”

Voice of Business

In keeping with its mission “to protect and promote commerce,” the Frisco Chamber takes a proactive stance on issues affecting businesses across the region. The Frisco Chamber’s Government Relations efforts lead policy discussions in Frisco and throughout North Texas. Guided by its four pillars, Inform, Educate, Engage, and Advocate, the Frisco Chamber ensures the voice of the business community is heard at every level of government, fostering an environment where commerce and community thrive.

The U.S. Chamber’s tax roundtables are part of its Growing America’s Future campaign, an education and advocacy initiative focused on maintaining a pro-growth tax code that supports a strong U.S. economy and benefits all Americans. These roundtables are being held across the country to engage local leaders and amplify the voices of small business owners who drive innovation and prosperity in their communities.